The Pentagon and A.I. Giants Have a Weakness. Both Need China’s Batteries, Badly.

In Northern Virginia’s Data Center Alley, windowless buildings the size of aircraft hangars are powering America’s artificial intelligence industry, which is locked in a race against China.

Yet, these data centers are increasingly reliant on China, America’s geopolitical rival, for a vital technology: batteries.

These facilities can use as much electricity as a small city, straining local power grids. Even flickers can have cascading effects, corrupting sensitive A.I. computer coding.

To cope, tech giants are looking to buy billions of dollars of large lithium-ion batteries, a field in which “China is leading in almost every industrial component,” said Dan Wang, an expert on China’s technology sector at Stanford’s Hoover Institution. “They’re ahead, both technologically and in terms of scale.”

A short drive from the data centers, at the Pentagon, military officials are sounding similar warnings, for different reasons. Military strategists, watching as modern warfare is reinvented in Ukraine, say the armed forces will need millions of batteries to power drones, lasers and countless other weapons of the future.

Many of those batteries, too, come from China.

Chinese battery dominance has long been a problem for industries like auto manufacturing, but now is increasingly being viewed as a national security threat. Currently, U.S. military forces rely on Chinese supply chains for some 6,000 individual battery components across weapons programs, according to Govini, a defense analytics firm.

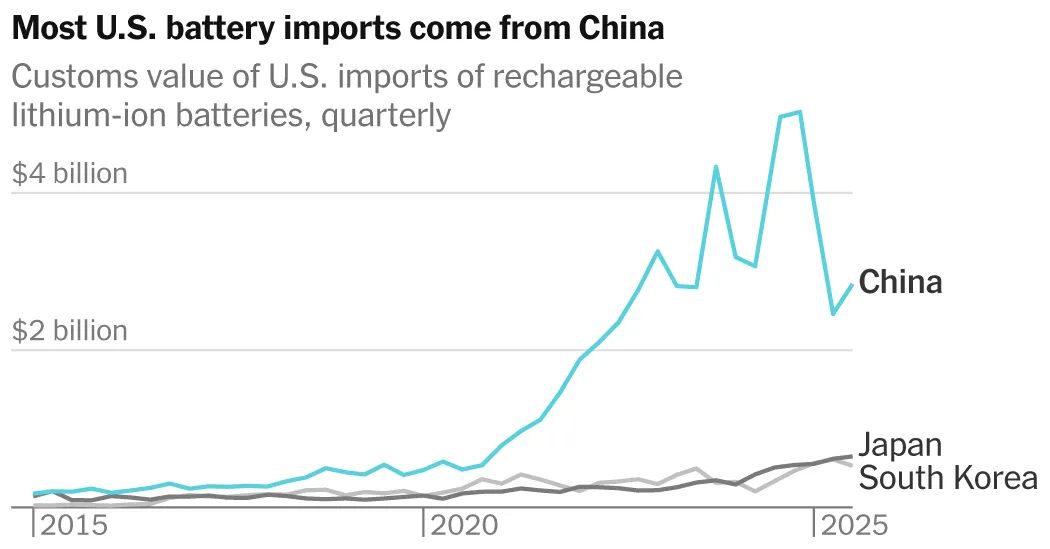

Most U.S. battery imports come from China

Customs value of U.S. imports of rechargeable lithium-ion batteries, quarterly

Note: Chart shows top three importing countries. Data through September 2025. Source: U.S. Census Bureau

“The reality is very stark,” Tara Murphy Dougherty, Govini’s chief executive, told a recent gathering of top defense and industry officials in California. “There are foreign parts in 100 percent of our weapon systems and military platforms.”

China understands the importance of these batteries. On Oct. 9, amid growing trade disputes, China threatened to limit exports of some of its most advanced lithium-ion technologies, including fundamental components like graphite anodes and cathodes.

The Trump administration is facing a dilemma.

When President Trump came to office, his administration initially froze billions of dollars in Biden-era federal grants for battery manufacturing, lumping batteries in with electric vehicles, solar farms, wind turbines and other clean energy technologies Mr. Trump had sought to de-emphasize. Mr. Trump has been scornful of electric cars, calling them a “scam.”

Yet more recently, the administration has come to see battery technology as pivotal for many of the things it cares most about, including A.I. and defense. In interviews, more than a dozen battery-industry executives, lobbyists, military experts and others close to the administration said the White House had taken a growing interest in fostering a domestic battery industry disentangled from China.

In recent weeks the White House has held high-level meetings on the battery supply chain, according to three people familiar with the matter. The National Energy Dominance Council, which Mr. Trump established to coordinate energy policy, has been meeting with battery companies. The Energy Department has quietly allowed many Biden-era grants for battery makers to proceed. It also recently announced up to $500 million for battery materials and recycling projects.

The administration has started investing in companies that develop battery components or critical minerals, including Eos, a next-generation battery company. As part of a trade deal, officials prodded Japan to promise to invest billions of dollars in U.S. battery manufacturing. And the National Defense Authorization Act, passed this month, includes Pentagon restrictions on battery purchases from “foreign entities of concern,” primarily China.

The administration is saying “we don’t like electric vehicles, but we do need batteries for drones and data centers and A.I.,” said Samm Gillard, executive director and co-founder of the Battery Advocacy for Technology Transformation Coalition, a trade group. “They’re recognizing that China’s stranglehold on the battery supply chain is undermining our national security.”

Taylor Rogers, a White House spokeswoman, said President Trump was “deploying all aspects of the government to work closely together” to “ensure the U.S. is the global leader in critical mineral and battery production.”

Experts say that building an industry not dependent on China will be enormously difficult. China is dominant in lithium iron phosphate batteries, or LFP, preferred for both E.V.s and for stationary storage.

China’s battery supply chain dominance

How much China controls each step of the process to make lithium iron phosphate batteries, the type most commonly used for energy storage

Mining

Graphite

Phosphorus

Lithium

Manganese

China

22%

86%

46%

4%

U.S.

1%

8%

Refining

Phosphorus

Lithium

Graphite

Manganese

73%

70%

95%

95%

0.2%

6%

1%

Components

Battery cells

Cathodes

Anodes

98%

94%

99%

Mining

Graphite

Phosphorus

Lithium

Manganese

China

86%

46%

22%

4%

U.S.

1%

8%

Refining

Phosphorus

Lithium

Graphite

Manganese

95%

73%

70%

95%

0.2%

6%

1%

Components

Battery cells

Cathodes

Anodes

94%

98%

99%

Mining

Tiv>

Phosporus

Lithium

86%

46%

22%

U.S.

Refining

Phosporus

Lithium

gramite

95%

Components

Battery cells